NSE Nifty 50 Index 2026: Complete Trading Guide & Live Stock List

Everything Indian traders need to know about Nifty 50 stocks, weightages, trading strategies & live market analysis

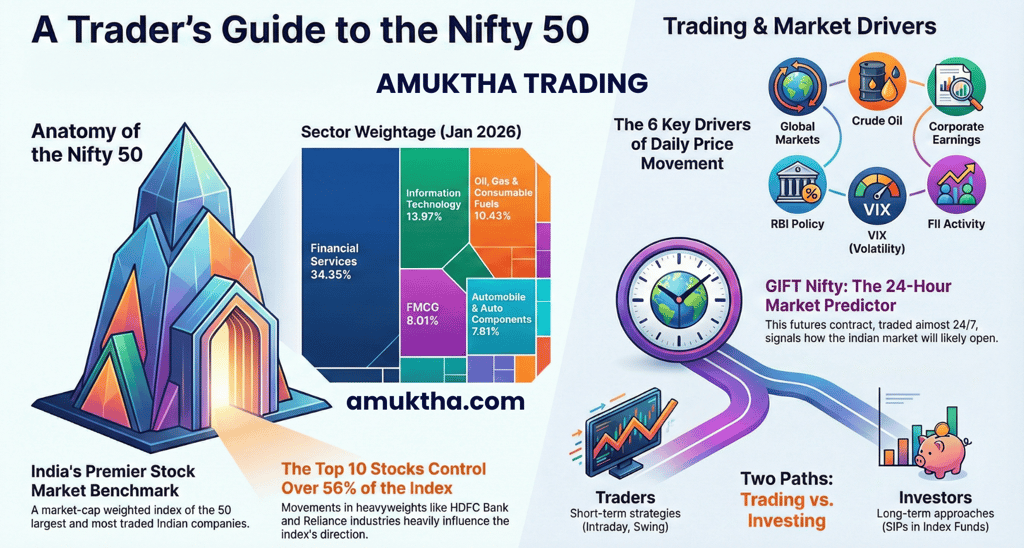

The Nifty 50 represents India's top 50 companies and serves as the primary benchmark for the Indian stock market. Whether you're a beginner trader looking to understand market movements or an experienced investor building a portfolio, mastering the Nifty 50 is essential. This comprehensive guide covers live stock weightages (updated January 2026), proven trading strategies, sector analysis, and how to profit from both rising and falling markets.

Last Updated: January 28, 2026 | Read Time: 12 minutes

What You'll Learn in This Guide

What is Nifty 50 and why it matters for every Indian trader

Live list of all 50 stocks with current weightages (Jan 2026)

Sector-wise breakdown showing which industries dominate

5 proven trading strategies used by professional traders

How GIFT Nifty predicts tomorrow's market opening

Key factors that move Nifty 50 prices daily

Investment approaches for long-term wealth building

What is Nifty 50? Understanding India's Stock Market Benchmark

The Nifty 50 is a market capitalization-weighted index tracking the performance of India's 50 largest and most liquid companies listed on the National Stock Exchange (NSE). Launched in 1996 with a base value of 1,000 points, it has become the go-to indicator for gauging India's economic health and stock market sentiment.

Why Every Trader Watches Nifty 50

• Market Direction Indicator: When Nifty rises, most Indian stocks follow. When it falls, the entire market feels the impact. Tracking Nifty 50 today gives you instant insight into market sentiment.

• High Liquidity: Nifty 50 stocks and derivatives see massive daily trading volumes, making it easy to enter and exit positions without price slippage.

• Portfolio Benchmark: Professional fund managers and retail investors alike compare their returns against Nifty 50 to measure performance.

• Derivative Trading Hub: Nifty 50 futures and options are among the most actively traded instruments globally, offering opportunities for hedging and speculation.

How is Nifty 50 Calculated? The Math Behind the Index

Understanding the calculation helps you predict how individual stock movements affect the index. Nifty 50 uses the free-float market capitalization method, which considers only shares available for public trading (excluding promoter holdings).

Formula: Nifty 50 = (Total Free-Float Market Cap of 50 Companies ÷ Base Market Cap) × 1000

What This Means for Traders: Larger companies like HDFC Bank (12.24% weight) have a bigger impact on Nifty movements than smaller constituents. A 2% move in HDFC Bank affects the index more than a 5% move in a company with 1% weightage.

Complete Nifty 50 Stock List with Live Weightages (January 2026)

Below is the official list of all 50 companies in the Nifty index, ranked by their weightage as of January 31, 2026. This data directly impacts how you should trade the index and which stocks to monitor closely.

Top 10 Nifty 50 Stocks by Weightage

These 10 companies account for over 56% of the total index value. Movements in these stocks directly determine Nifty's direction on any given day.

HDFC Bank Ltd – 12.24% (Banking)

ICICI Bank Ltd – 8.38% (Banking)

Reliance Industries Ltd – 8.14% (Energy/Retail)

Infosys Limited – 6.42% (IT Services)

Bharti Airtel Limited – 4.13% (Telecom)

Tata Consultancy Services – 3.98% (IT Services)

Larsen & Toubro Ltd – 3.98% (Construction)

ITC Ltd – 3.94% (FMCG/Hotels)

State Bank of India – 2.82% (Banking)

Axis Bank Limited – 2.66% (Banking)

Full List of All 50 Nifty Stocks

Remaining 40 companies (alphabetically with weightage):

Asian Paints Limited – 0.99%

Bajaj Finance Limited – 2.09%

Bharat Electronics Ltd – 0.99%

HCL Technologies Ltd – 1.73%

Hindustan Unilever Ltd – 2.08%

ITC Hotels Limited – 0.14%

Kotak Mahindra Bank Ltd – 2.65%

Mahindra & Mahindra Ltd – 2.51%

Maruti Suzuki India Ltd – 1.53%

NTPC Ltd – 1.45%

Oil and Natural Gas Corporation – 0.97%

Power Grid Corporation of India Ltd – 1.29%

Sun Pharmaceutical Industries Ltd – 1.78%

Tata Motors Limited – 1.42%

Tata Steel Limited – 1.06%

Tech Mahindra Limited – 1.01%

Titan Company Limited – 1.37%

Trent Ltd – 1.21%

UltraTech Cement Limited – 1.24%

Nifty 50 Sector Analysis: Which Industries Drive the Index?

Understanding sector composition helps you predict how different economic events affect Nifty. For example, an RBI interest rate hike primarily impacts Financial Services stocks, which control 34.35% of the index.

Complete Sector Weightage Breakdown

Financial Services – 34.35% (Banks dominate: HDFC, ICICI, SBI, Axis, Kotak)

Information Technology – 13.97% (Infosys, TCS, HCL, Tech Mahindra)

Oil, Gas & Consumable Fuels – 10.43% (Reliance, ONGC)

FMCG – 8.01% (ITC, Hindustan Unilever)

Automobile & Auto Components – 7.61% (Maruti, Tata Motors, M&M)

Telecommunications – 4.13% | Construction – 3.98% | Healthcare – 3.91% | Metals – 3.27% | Power – 2.75% | Others – 7.59%

How to Use Sector Data for Trading Decisions

Banking News = Nifty Impact: With 34.35% in Financial Services, any RBI policy changes or banking sector news significantly moves the index.

IT Sector & Dollar Movements: A stronger rupee typically hurts IT stocks (13.97% of Nifty), as these companies earn in dollars.

Crude Oil Prices: Rising oil affects both Oil & Gas companies (10.43%) and Auto sector margins (7.61%).

7 Key Factors That Move Nifty 50 Prices Daily

Professional traders monitor these factors to anticipate Nifty movements before they happen. Understanding these drivers gives you a significant edge.

1. GIFT Nifty: Your Crystal Ball for Market Opening

GIFT Nifty (formerly SGX Nifty) is a Nifty 50 futures contract traded at GIFT City, India. It trades nearly 24 hours, giving you advance signals about how Indian markets will open. For example, if GIFT Nifty is up 150 points at 8:00 AM, expect Nifty to open positively. Traders use this to prepare their strategies before the 9:15 AM market opening.

2. Foreign Institutional Investor (FII) Activity

FIIs control massive capital and their buying/selling creates trends. When FIIs buy aggressively, Nifty rallies. When they sell (often due to US Federal Reserve rate hikes or global uncertainties), Nifty falls. Track daily FII data on NSE's website to understand institutional sentiment.

3. RBI Monetary Policy & Interest Rates

Interest rate changes directly affect corporate borrowing costs and bank profitability. Rate hikes typically lead to short-term Nifty declines, while rate cuts boost market sentiment. Given that Financial Services comprise 34.35% of Nifty, RBI decisions have outsized impact.

4. Corporate Earnings Reports

Quarterly results from Nifty 50 companies drive individual stock movements. Strong earnings from heavyweights like HDFC Bank or Reliance can single-handedly lift the index by 100+ points. Earnings season (January, April, July, October) sees heightened volatility.

5. Global Market Sentiment & US Markets

Indian markets increasingly follow US market trends. A strong close on Wall Street (S&P 500, Dow Jones) often leads to positive GIFT Nifty and bullish opening in India. Conversely, US market crashes trigger panic selling in Nifty.

6. Crude Oil Prices

India imports 80% of its crude oil needs. Rising oil prices increase inflation, widen fiscal deficit, and hurt sectors like Aviation and Automobiles. Oil spikes above $90-100 per barrel historically correlate with Nifty corrections.

7. India VIX (Volatility Index)

VIX measures expected market volatility. High VIX (above 20-25) indicates fear and uncertainty, often coinciding with falling markets. Low VIX (below 15) suggests complacency and stable/rising markets. Options traders use VIX to adjust their strategies.

5 Proven Nifty 50 Trading Strategies Used by Professionals

These strategies are battle-tested and used daily by successful traders. Choose based on your risk tolerance, available time, and market conditions.

Strategy 1: Intraday Trading – Capturing Daily Movements

Best For: Traders who can monitor markets during trading hours (9:15 AM - 3:30 PM)

Time Commitment: Full trading session

Risk Level: High (use strict stop losses)

How It Works:

Check GIFT Nifty at 8:00-9:00 AM to gauge opening direction

Identify key support (e.g., 21,500) and resistance levels (e.g., 21,800)

Use 15-minute candles with indicators like RSI (Relative Strength Index) and MACD

Enter long if Nifty breaks above resistance with volume; short if it breaks below support

Set stop loss at 30-50 points; target 80-150 points profit

Pro Tip: Avoid trading during the first 15 minutes (9:15-9:30 AM) as volatility spikes. Wait for a clear trend to emerge.

Strategy 2: Swing Trading – Riding Multi-Day Trends

Best For: Part-time traders who check markets once or twice daily

Time Commitment: 30 minutes daily

Risk Level: Medium

How It Works:

Analyze daily charts to identify trends (use 50-day and 200-day moving averages)

Look for breakout patterns (head and shoulders, triangles, flags)

Hold positions for 3-10 days to capture larger moves

Use Fibonacci retracement levels (38.2%, 50%, 61.8%) to identify entry points

Example: Nifty breaks above 21,800 resistance with high volume. Enter long with stop loss at 21,600. Target 22,200-22,500 over the next week.

Strategy 3: Nifty Options Trading – Limited Risk, Unlimited Potential

Best For: Experienced traders who understand derivatives

Risk Level: Can be controlled (buying options) or high (selling options)

Popular Strategies:

Long Call: Buy call option if expecting Nifty to rise. Max loss = premium paid.

Long Put: Buy put option if expecting Nifty to fall. Max loss = premium paid.

Straddle: Buy both call and put at the same strike. Profit from big moves in either direction. Use before major events (Budget, RBI policy).

Iron Condor: Advanced strategy for range-bound markets. Sell out-of-money call and put, buy further out-of-money options for protection.

Warning: Options decay in value as expiry approaches (theta decay). Always have an exit plan.

Strategy 4: Positional Trading – Weeks to Months

Similar to swing trading but with longer holding periods. Traders analyze macro trends, economic data, and sector rotations. Requires patience and the ability to withstand short-term volatility. Best suited for trending markets with clear directional bias.

Strategy 5: Hedging with Nifty Futures

If you hold a portfolio of stocks, you can hedge against market downturns by shorting Nifty futures. For example, if you own ₹10 lakhs worth of stocks and fear a correction, selling 2 Nifty futures contracts (lot size 25, approx value ₹5.4 lakhs) can offset losses. This insurance costs you the margin requirement but protects your portfolio.

Trading Psychology: The Hidden Success Factor

90% of trading success is mental. Technical analysis and strategies mean nothing if you can't control emotions. Here are the critical psychological principles every Nifty trader must master.

Discipline Over Emotion

Stick to your trading plan religiously. Don't increase position size after wins (greed) or try to recover losses immediately (revenge trading). Set daily profit and loss limits and stop trading once hit.

Accept Losses as Part of the Game

Even the best traders have 40-60% win rates. What matters is ensuring winners are larger than losers (risk-reward ratio of 1:2 or better). One ₹15,000 winning trade can offset three ₹5,000 losses.

Avoid Overtrading

Quality over quantity. Taking 2-3 high-probability setups per week beats making 20 random trades. Excessive trading leads to death by a thousand cuts through brokerage fees and bad decisions.

Investment Strategies for Long-Term Nifty 50 Wealth Building

While traders focus on short-term price movements, investors take a different approach focused on compounding returns over years. Here's how to build wealth through Nifty 50 investing.

1. Systematic Investment Plan (SIP) in Nifty 50 Index Funds

How It Works: Invest a fixed amount (₹5,000, ₹10,000, ₹25,000) monthly into Nifty 50 ETFs or index mutual funds.

Benefits:

Rupee cost averaging: Buy more units when market is low, fewer when high

Disciplined investing without market timing stress

Historically, Nifty 50 has delivered 12-15% annual returns over 15+ year periods

Recommended Funds: ICICI Prudential Nifty 50 Index Fund, UTI Nifty 50 Index Fund, Nippon India ETF Nifty BeES

2. Lump Sum Investment During Market Corrections

If you have capital available, buying during 10-20% market corrections offers excellent long-term returns. For example, investors who bought Nifty 50 during the March 2020 COVID crash at 7,500 levels saw it rise to 22,000+ by 2026 – a near 3x return in under 5 years.

3. Dividend Investing Strategy

Many Nifty 50 companies like ITC, Coal India, and ONGC pay regular dividends. Creating a portfolio of high-dividend Nifty stocks can generate passive income while benefiting from capital appreciation. Reinvesting dividends compounds wealth faster.

GIFT Nifty vs Nifty 50: Understanding the Critical Difference

Traders often confuse these two, but understanding the distinction gives you a powerful predictive edge for market openings.

What is GIFT Nifty?

GIFT Nifty is a Nifty 50 futures contract traded at the Gujarat International Finance Tec-City (GIFT City) in India. It replaced SGX Nifty (Singapore Exchange) in July 2022. It allows global traders to take positions on Indian markets outside regular trading hours.

Key Differences

Trading Hours:

Nifty 50: 9:15 AM to 3:30 PM IST

GIFT Nifty: 6:30 AM to 3:40 AM IST (next day) – nearly 24 hours

Purpose:

Nifty 50: Cash market benchmark index

GIFT Nifty: Futures contract for global traders; predictive indicator for next day's opening

How Traders Use GIFT Nifty

Check GIFT Nifty at 8:00-9:00 AM to gauge sentiment. If GIFT Nifty is trading 100 points above previous day's close, expect a gap-up opening. If 100 points below, expect gap-down. This pre-market information allows you to plan your opening trades, set stop losses, and position yourself ahead of the crowd.

Take Your Nifty 50 Trading to the Next Level

Understanding Nifty 50 is just the beginning. Consistent profitability requires combining knowledge with disciplined execution, risk management, and continuous learning. Whether you're trading intraday, swing trading, using options, or building long-term wealth through index investing, the strategies outlined in this guide give you a complete framework.

Your Next Steps

Start small: Paper trade or use small capital until you master one strategy

Track your trades: Maintain a journal noting entry, exit, reason, and outcome

Learn continuously: Markets evolve. Stay updated with economic news, earnings, and global trends

Get expert guidance: Working with an experienced trading mentor can compress your learning curve from years to months

Want detailed analysis of each Nifty 50 stock? Sector-specific reports? Or personalized trading guidance?

Message us on WhatsApp

We'll share comprehensive stock reports, sector analysis, and connect you with our expert trading mentors.

About Amuktha

Amuktha is a leading stock market education platform helping traders master Nifty 50, derivatives, technical analysis, and portfolio management. Our expert mentors have trained thousands of successful traders across India. Visit amuktha.com to explore our courses and services.

Disclaimer:- Trading in securities markets carries substantial risk and is not suitable for everyone. Past performance is not indicative of future results. This article is for educational purposes only and should not be construed as investment advice. Always conduct your own research and consider consulting with qualified financial professionals before making trading decisions.