Nifty Trading Strategy for Tomorrow: Key Levels, Analysis & Actionable Setups

Quick Summary: Tomorrow's Nifty Outlook

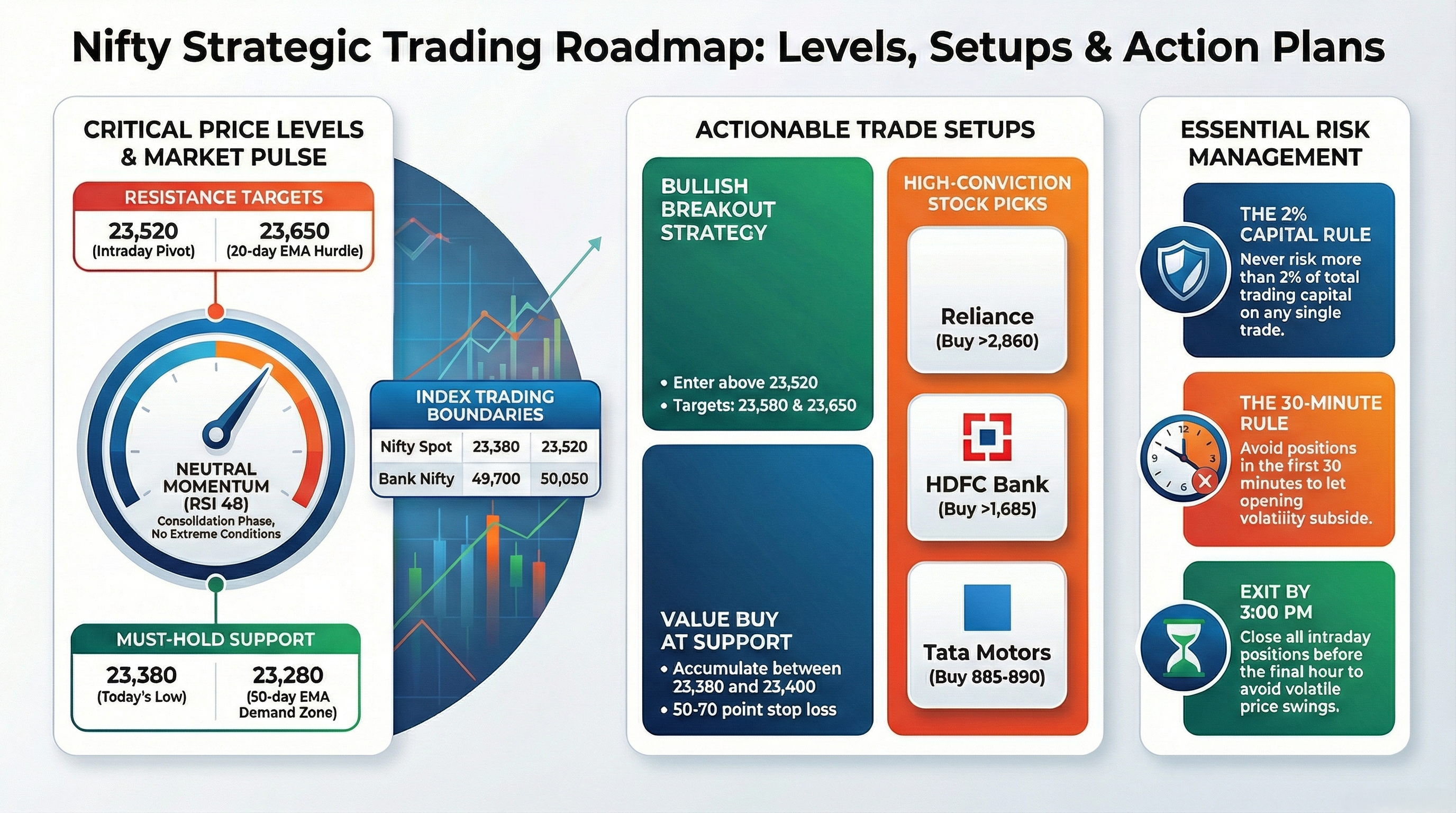

Nifty Spot Close: 23,450 (-0.35%)

Expected Range: 23,300 - 23,650

Trend: Sideways to mildly bullish

Key Event: US inflation data impact, FII activity

Trading Bias: Buy on dips near support with strict stop-loss

Market Recap: What Happened Today?

Nifty opened with a gap-down at 23,420 following weak global cues, primarily due to concerns over US Federal Reserve policy signals. The index tested the crucial 23,380 support level twice during the session before recovering in the final hour, supported by buying in banking and auto stocks.

Key Highlights:

Bank Nifty: Outperformed with a gain of 0.25%, closing at 49,850

FII Activity: Net sellers with ₹1,200 crore outflow in index futures

Advance/Decline Ratio: 1.2:1 (moderately positive)

Sectoral Performance: IT and Pharma led gains; FMCG and Metals declined

The market showed resilience despite negative opening, indicating buying interest at lower levels. However, weak global sentiment and FII selling pressure continue to cap upside momentum.

Tomorrow's Nifty Trading Strategy: Technical Analysis

Critical Support and Resistance Levels

Resistance Levels (The Upside)

Strong Resistance (23,650): This is a major hurdle aligned with the 20-day EMA. A move above this is considered a key breakout level for a potential bullish trend.

Immediate Resistance (23,520): This acts as the intraday pivot. Watch this level for early signs of strength during the session.

Current Market Standing

Current Level (23,450): This represents today’s closing price, serving as the baseline for the next trading session.

Chart Pattern Analysis

Nifty is currently forming a symmetrical triangle pattern on the hourly chart, with consolidation between 23,280 and 23,650. A decisive breakout on either side could trigger a 150-200 point move.

Support Levels (The Downside)

Immediate Support (23,380): This level marks today’s low and is currently a significant demand zone where buyers have previously stepped in.

Strong Support (23,280): A critical level sitting on the 50-day EMA. This is a "must-hold" zone to maintain the medium-term health of the current trend.

Key Indicators:

RSI (14): 48 (Neutral zone, no extreme overbought/oversold condition)

MACD: Showing bullish crossover on 1-hour chart

Volume: Below average, indicating consolidation phase

Bollinger Bands: Price trading near middle band; range-bound setup

Actionable Trading Setups for Tomorrow

Setup 1: Bullish Breakout Trade (Higher Probability)

Entry Trigger: If Nifty sustains above 23,520 for 15 minutes

Entry Price: 23,525

Target 1: 23,580

Target 2: 23,650

Stop Loss: 23,475 (50 points risk)

Risk-Reward Ratio: 1:2.5

Trade Logic: A breakout above 23,520 with volume confirmation would signal continuation of the recovery trend. Bank Nifty strength can support this move.

Position Sizing Example:

If your trading capital is ₹1,00,000 and risk tolerance is 2%:

Maximum risk = ₹2,000

Stop loss = 50 points = ₹50 per lot (assuming 1 lot)

You can take 1-2 lots based on account size

Setup 2: Support Zone Buying (Value Trade)

Entry Zone: 23,380 - 23,400

Entry Strategy: Buy in two parts (50% at 23,400, 50% at 23,380)

Target 1: 23,480

Target 2: 23,550

Stop Loss: 23,330 (50-70 points risk)

Risk-Reward Ratio: 1:2

Trade Logic: This level acted as strong support today. If global markets stabilize, we could see a bounce from this demand zone.

Important: Only take this trade if Nifty approaches this zone in the first half of the trading session with low volatility.

Setup 3: Range Trading Strategy (Conservative)

For Intraday Traders:

Sell near: 23,500-23,520 with target 23,430-23,450

Buy near: 23,380-23,400 with target 23,470-23,490

Stop Loss: 40-50 points on either side

Condition: Only if market opens flat and shows range-bound behaviour in first 30 minutes

Note: Exit all positions by 3:00 PM to avoid last-hour volatility.

Bank Nifty Strategy for Tomorrow

Bank Nifty is showing relative strength and could outperform Nifty.

Key Levels:

Resistance: 50,050 | 50,200

Support: 49,700 | 49,500

Trading Strategy:

Bullish Above: 49,900 - Target 50,150

Bearish Below: 49,650 - Target 49,450

Stop Loss: 80-100 points

Bank Nifty traders should watch HDFC Bank, ICICI Bank, and Axis Bank for directional cues.

Top 3 Stock Picks for Tomorrow

1. Reliance Industries (RIL)

Current Price: ₹2,845

Trade Setup: Buy above ₹2,860 | Target: ₹2,920 | Stop Loss: ₹2,830

Reason: Breaking out of consolidation; strong volume buildup

Risk-Reward: 1:2.5

2. HDFC Bank

Current Price: ₹1,678

Trade Setup: Buy above ₹1,685 | Target: ₹1,715 | Stop Loss: ₹1,670

Reason: Holding above crucial support; banking sector strength

Risk-Reward: 1:2

3. Tata Motors

Current Price: ₹892

Trade Setup: Buy in range ₹885-890 | Target: ₹910 | Stop Loss: ₹878

Reason: Auto sector showing resilience; bullish flag pattern

Risk-Reward: 1:2.5

Global Cues to Watch Tomorrow

Overnight Developments:

US Markets: Dow closed flat, Nasdaq up 0.3%

Asian Markets: Mixed; Nikkei down 0.2%, Hang Seng up 0.5%

Gift Nifty: Trading at 23,470 (20 points premium - mildly positive)

Crude Oil: $77.50/barrel (stable)

Dollar Index: 108.5 (slightly weak)

Key Events:

US housing data release (7:00 PM IST)

FII/DII data (post-market)

No major domestic economic data

Impact Assessment: Neutral to slightly positive opening expected (gap-up of 10-20 points possible).

Options Trading Strategy for Tomorrow

Nifty Options Analysis (Weekly Expiry)

Put-Call Ratio (PCR): 1.08 (Neutral to mildly bullish)

Maximum Put Open Interest: 23,300 PE (strong support)

Maximum Call Open Interest: 23,500 CE (immediate resistance)

Option Strategies for Tomorrow:

Strategy 1: Bull Call Spread (Low Risk)

Buy: 23,500 CE at ₹80

Sell: 23,600 CE at ₹40

Net Premium: ₹40 per lot

Maximum Profit: ₹60 (if Nifty closes above 23,600)

Maximum Loss: ₹40 (limited)

Breakeven: 23,540

When to Use: If you're moderately bullish but want limited risk.

Strategy 2: Iron Condor (Range-Bound Market)

Sell: 23,600 CE at ₹40

Buy: 23,700 CE at ₹20

Sell: 23,300 PE at ₹45

Buy: 23,200 PE at ₹25

Net Credit: ₹40 per lot

Maximum Profit: ₹40 (if Nifty stays between 23,300-23,600)

Maximum Loss: ₹60

When to Use: If you expect Nifty to trade in a range.

Risk Management Rules for Tomorrow

Essential Guidelines:

Position Sizing: Never risk more than 2% of capital on a single trade

Stop Loss Discipline: Place stop loss immediately after entry; don't wait

Target Management: Book 50% profit at first target; trail rest with stop loss

Avoid Overtrading: Take maximum 2-3 quality setups; skip if conditions don't align

News Trading: Avoid trading during major news events unless you're experienced

Common Mistakes to Avoid:

❌ Trading without stop loss hoping for recovery

❌ Averaging down on losing positions

❌ Revenge trading after a loss

❌ Trading beyond your risk capital

❌ Ignoring broader market trend

Sector-Wise View for Tomorrow

Market Sector Outlook & Key Stocks to Watch

Bullish Growth Sectors

Banking

Outlook: Bullish

Key Stocks: HDFC Bank, ICICI Bank, SBI

Auto

Outlook: Bullish

Key Stocks: Tata Motors, M&M, Maruti

Positive Momentum Sectors

Pharma

Outlook: Positive

Key Stocks: Sun Pharma, Dr. Reddy's

IT

Outlook: Neutral to Positive

Key Stocks: TCS, Infosys, Tech Mahindra

Neutral / Range-Bound Sectors

FMCG

Outlook: Neutral

Key Stocks: HUL, ITC

Energy

Outlook: Neutral

Key Stocks: Reliance, ONGC

Bearish / Cautious Sectors

Metals

Outlook: Bearish

Key Stocks: Tata Steel, JSW Steel

What If Scenarios: Contingency Plans

Scenario 1: Gap-Up Opening (50+ points)

Action: Wait for 15-30 minutes; watch for profit booking. If sustains above 23,520, look for breakout trades. Avoid chasing immediately.

Scenario 2: Gap-Down Opening (50+ points)

Action: Check if it's due to global events or domestic news. If gap-down near 23,350-23,380, prepare for support zone buying. Wait for reversal confirmation.

Scenario 3: Flat Opening (±20 points)

Action: Best scenario for range trading strategy. Watch first hour price action to determine trend.

Scenario 4: High Volatility / Trending Move

Action: Switch from range trading to trend-following strategy. Use wider stop losses and trail profits.

Expert Tips from Amuktha Trading Mentors

Tip 1: First 30 Minutes Rule

"Never take any position in the first 15-30 minutes of trading. Let the market show its hand. Opening volatility often creates false breakouts."

Tip 2: Volume Confirmation

"A breakout without volume is a trap. Always check if price movement is supported by above-average volume, especially in index futures."

Tip 3: Follow Your Plan

"The best strategy fails without discipline. Write down your entry, exit, and stop loss before the market opens. Stick to your plan regardless of emotions."

Tip 4: Track Your Trades

"Maintain a trading journal. Note down your entry reason, emotions, and outcome. Review weekly to identify patterns in your winning and losing trades."

Frequently Asked Questions (FAQs)

Q1: What time should I enter trades tomorrow?

A: Wait until 9:30-9:45 AM to assess opening range. The best entry opportunities often come between 9:45 AM and 10:30 AM, or during the last hour (2:30-3:15 PM).

Q2: Should I hold positions overnight in current market conditions?

A: Given the current volatility and weak global cues, it's safer to close all intraday positions by 3:15 PM unless you're a positional trader with proper risk management.

Q3: How much capital should I allocate to each trade?

A: Use the 2% rule: Risk only 2% of your total trading capital per trade. For a ₹1 lakh account, that's ₹2,000 maximum risk per trade.

Q4: What if Nifty doesn't reach my entry levels?

A: Don't force trades. It's perfectly fine to stay out of the market if your conditions aren't met. Preservation of capital is more important than being in the market every day.

Q5: Can beginners follow these strategies?

A: Yes, but start with paper trading or very small position sizes (1 lot). Focus on the support zone buying strategy first as it has clearer risk parameters.

Q6: How do I know if a breakout is genuine?

A: Check for three confirmations: (1) Price sustaining above breakout level for 15+ minutes, (2) Volume spike, (3) Broader market supporting the move.

Q7: What's the difference between Nifty and Bank Nifty trading?

A: Bank Nifty is more volatile (moves 2-3x faster) and requires wider stop losses. Nifty is better for beginners due to relatively smoother price action.

Q8: Should I trade options or futures tomorrow?

A: Futures are better if you have a clear directional view and can handle leverage. Options are better for defined-risk strategies, especially in uncertain conditions.

Disclaimer & Risk Warning

Important Notice:

Trading in stocks, derivatives, and other securities involves substantial risk and is not suitable for all investors. The strategies, analysis, and recommendations provided in this article are for educational purposes only and should not be construed as financial advice.

Key Points:

Past performance is not indicative of future results

You should only trade with capital you can afford to lose

Always consult with a SEBI registered financial advisor before making investment decisions

Market conditions can change rapidly; the analysis is based on data available as on today

Amuktha Trading Services is not responsible for any losses incurred by following these strategies

Regulatory Disclosure: Amuktha Trading Services provides educational content and mentorship. We do not guarantee profits or returns. All trading decisions are the sole responsibility of the individual trader.

Get Personalized Trading Mentorship

Want to improve your trading skills and get daily market analysis customized to your trading style?

What You Get with Amuktha Trading Mentorship:

✅ Daily Pre-Market Analysis - Detailed Nifty and Bank Nifty levels sent by 9:00 AM

✅ Live Trade Alerts - Real-time entry/exit signals during market hours

✅ One-on-One Mentorship - Personalized guidance based on your capital and goals

✅ Strategy Development - Custom trading plans for intraday, swing, and positional trading

✅ Risk Management Training - Learn to protect capital and maximize returns

✅ Trading Psychology Sessions - Master emotional discipline and decision-making

Special Offer: Free 7-Day Trial

Experience our premium services with no commitment:

7 days of daily market analysis

3 live trade setups

👉 Click Here to Start Your Free Trial

Contact Us:

📞 Phone: 7382177772

📧 Email: info@amuktha.com

🌐 Website: www.amuktha.com

📱 WhatsApp: 7382177772

Join Our Trading Community

Connect with 5,000+ traders learning and growing together:

WhatsApp Community: Daily updates, market analysis, and trade discussions

YouTube: Video analysis and strategy tutorials (New videos every Monday & Thursday)

Twitter: Quick market updates and breaking news impact

Instagram: Visual chart analysis and educational posts

Tomorrow's Action Plan Checklist

Use this checklist to prepare for tomorrow's trading session:

Before Market Opens (9:00 AM):

Check Gift Nifty and global markets

Review support and resistance levels

Identify 2-3 stocks to watch

Set price alerts on trading platform

Review your trading plan

During Market Hours:

Wait for first 30 minutes to pass

Execute only planned trades

Place stop loss immediately after entry

Book partial profits at first target

Avoid revenge trading after losses

After Market Close:

Review all trades taken

Update trading journal

Calculate P&L and analyze mistakes

Plan for next trading day

Check tomorrow's economic calendar

Final Thought: Success in trading comes not from being right all the time, but from managing your winners and cutting your losers quickly. Trade with discipline, stick to your plan, and let the probabilities work in your favor over time.

Good luck with tomorrow's trading session!

Disclaimer:- Trading in securities markets carries substantial risk and is not suitable for everyone. Past performance is not indicative of future results. This article is for educational purposes only and should not be construed as investment advice. Always conduct your own research and consider consulting with qualified financial professionals before making trading decisions.